Smart Insider

Although the trading activity of company directors (insiders) can offer valuable clues related to future share performance, investors are unable to monitor all the relevant trades. Identifying 'Smart Insiders' through specialist desktops or quantitative feeds enables our clients to generate alpha.

GET IN TOUCHOur Data Analytics

Insider Transactions

The trading activity of company directors (insiders) can offer valuable clues to future share performance although most trades offer no insight at all. To profit from insider trades, investors need to screen out the ‘noise’ and focus on the most relevant trades. Identifying trades which depart from normal trading patterns and reveal a genuine conviction by insiders is our focus. Those trades are rare and cannot be identified from source data alone. Our specialist service enables clients to generate alpha from timely delivery and analysis of trades and related factors. Backed by extensive historic research, our data ensures the truly indicative trades are brought to the attention of our clients in a timely manner with added context.

Show More

Share Buybacks

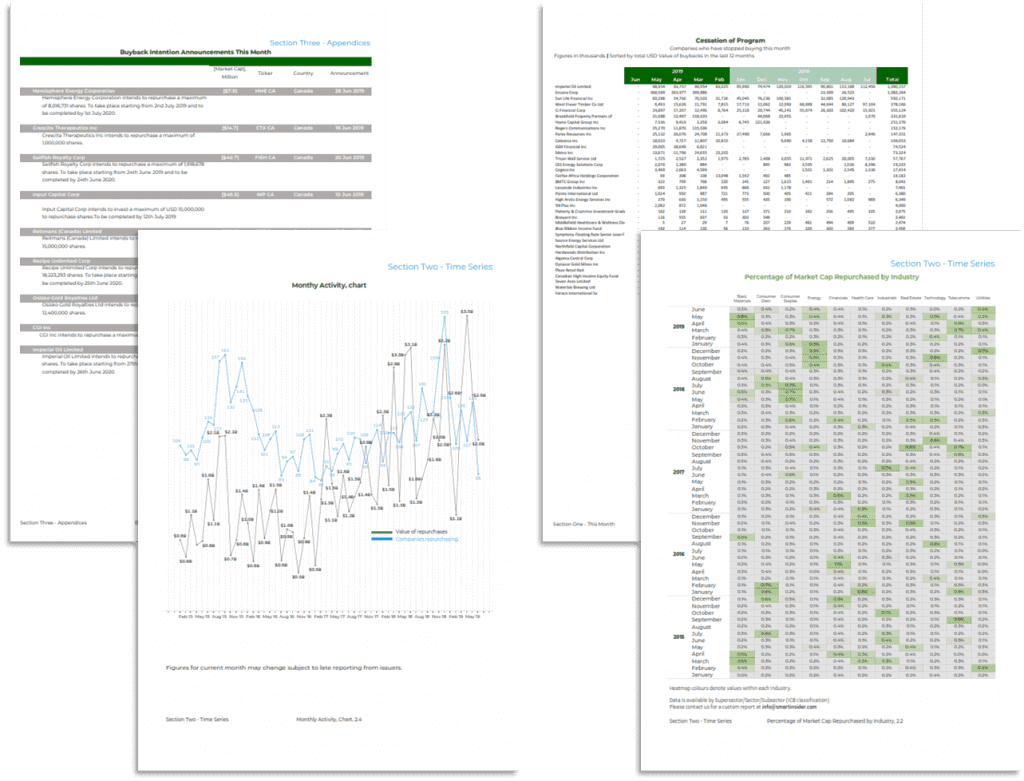

Our Company buyback data tracks and analyses the amount and value of shares bought back by listed companies (Issuers). Covering every market where share repurchases are reported, our global offering also includes ‘Buyback Announcements’ which details the Issuers stated intentions before buybacks are executed. By comparing each companies stated intentions with their executed trades, we are able to establish patterns to help predict likely trading decisions ahead. Our reports and alerts cut through the statistical noise to provide clients with concise, timely corporate share repurchase data tailored to their stock universe

Show More

Director Insights

We monitor reported changes in company boardrooms as they occur, giving clients concise information on movements in Boardroom personnel. Including exact job titles, biographies, appointment dates, and role changes our data gives a clear profile of each Corporate Board and the changes within it. Director biographies, salaries and the monetary value of their holdings ensures clients can establish the most influential members of a Corporate Board and track important changes in the stocks that matter most to them.

Show More

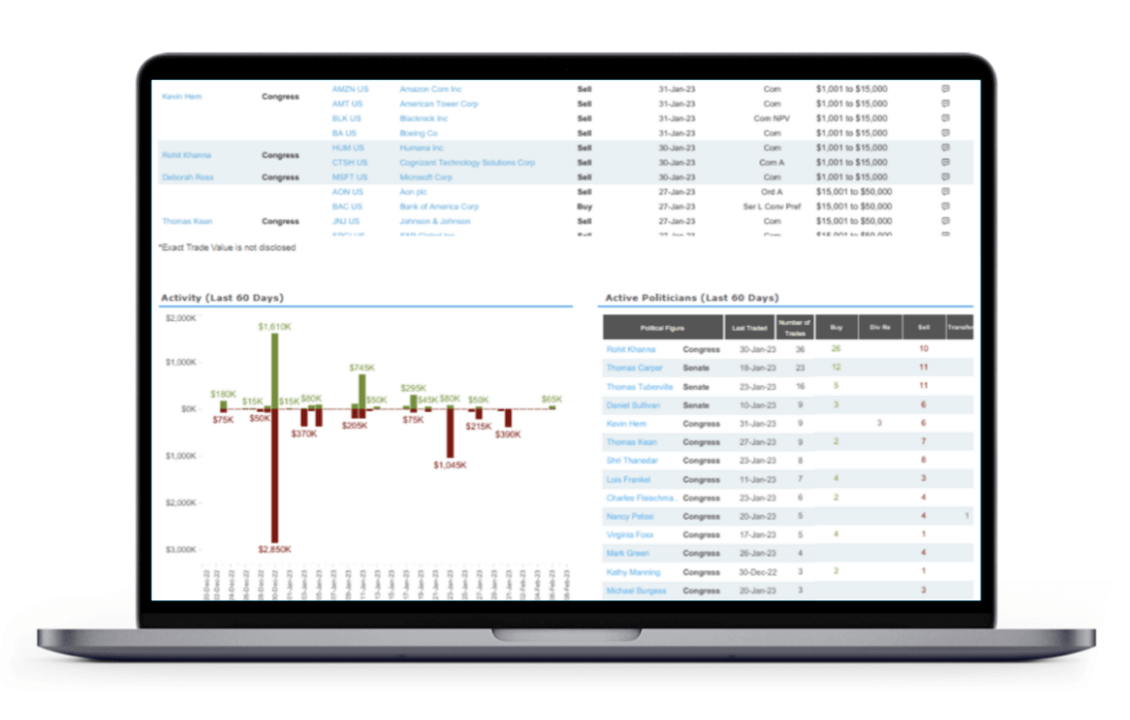

US Politicians Data

Reporting rules in the US require Congressmen and Senators to publish details of their trades in company shares globally. The data shows which politicians have a vested interest in certain stocks and when they acquired it. This helps clients see who owns the stocks of interest to them, and see a list of the stocks each individual Politician owns.

Show MoreDelivery Options

Our quant offering includes both buyback transactions and buyback

intentions.

Whether you are a fund manager, investor, company executive, or analyst, our delivery

can

be customized to the way you look at data and can integrate with your internal processes

and workflow. We provide full customization of reports delivered by desktop, through

feeds, or alerts. Our quant clients can receive data in a variety of formats via

SFTP, API, Snowflake or AWS S3 and include point-in-time

processes.

Consists of the timely delivery of share repurchases data

and buyback

announcements Suited to the needs and preferences of our clients. You will also find

advanced

presentation materials to provide additional insight.

Have a specific requirement or want to make sure you get the best value? Our sales and

support team is always at hand to train you on how to best tailor our corporate buyback

data to your needs. We provide customised reports in different formats and deliver them

to your expectations.

Explore our signals service which consists of the insider trades that matter the most. We conduct high quality quantitative and qualitative analysis and highlight the trades that are most predictive of future share performance. Our research team provides comprehensive insights and commentary on these forecasts.

Director Insights

Like the rest of our content, we deliver data to suit the needs of our clients. This may include reports sent to the desktop at defined intervals, to a nightly feed of updates via FTP or an API.

Investor Relations or Human Resource departments can receive a concise list of boardroom personnel changes across a finite list of peer companies.

Like the rest of our content, we deliver data to suit the needs of our clients. This may include reports sent to the desktop at defined intervals, to a nightly feed of updates via FTP or an API.

Our Clientele

- Analysts and Fund Managers seeking to incorporate Insider insight signals into their investment process

- Buyside and Sellside analysts looking for market sentiment data

- Quants looking to enhance systematic strategies with alternative data sources

- ESG specialists seeking aspects of corporate governance

PEOPLE

Head of Research

Quantitative Analyst

Quantitative Research Analyst

Quantitative Strategist

Senior Analyst

INSTITUTIONS

Hedge Funds

Family Offices

Institutional Portfolio Managers

Institutional Investors

Asset Managers

Latest Insights

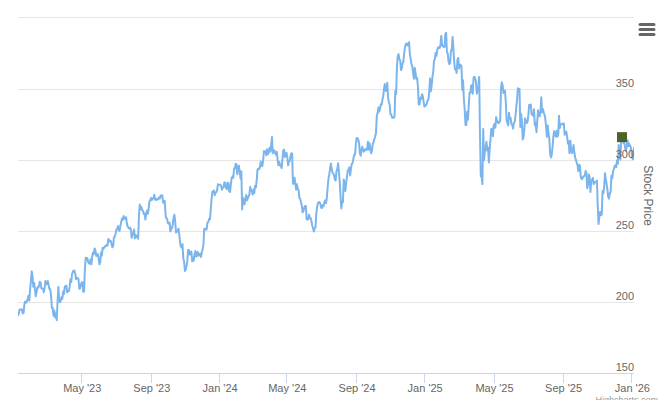

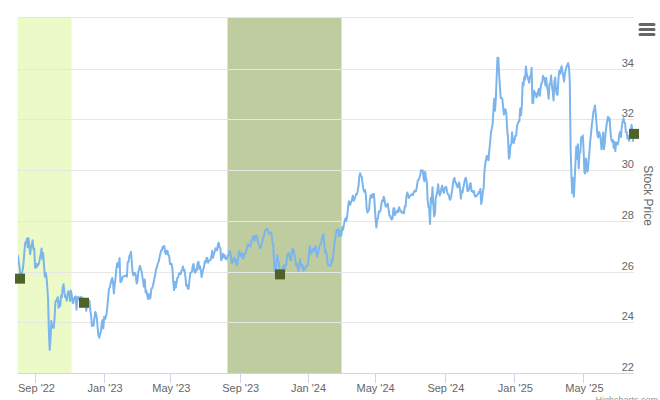

$LPG.US Ranked Positive On Jan 12th, 2026

Dorian LPG Ltd (LPG US, +1, 12-Jan-26) John Hadjipateras (Chairman, President & Chief Executive Officer since inception in...

Read More »

$CPAY.US Ranked Positive On Jan 6th, 2026

Corpay Inc (CPAY US, +1, 6-Jan-26) Steven Stull (Non-Executive since Oct 2000) bought $2.5 million of stock on December 12th at...

Read More »

$EPD.US Ranked Positive On Dec 30th, 2025

Enterprise Products Partners LP (EPD US, +1, 30-Dec-25) John Rutherford (Director since Jan 2019) made another large purchase,...

Read More »Smart Insider Data

Smart Insider provides share trade analytics & advanced data inputs for multi factor stock selection models, including actionable insights for institutional investors

REQUEST TRIAL