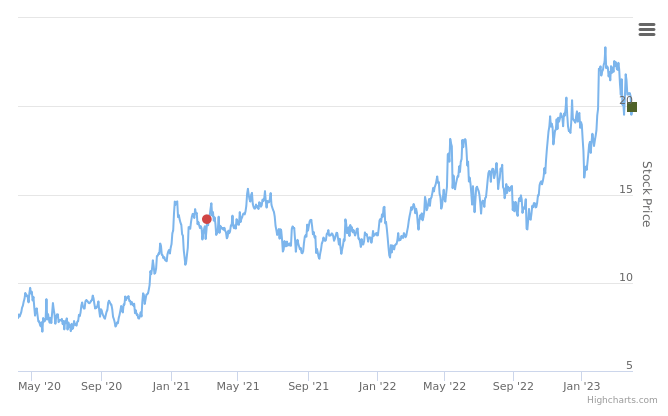

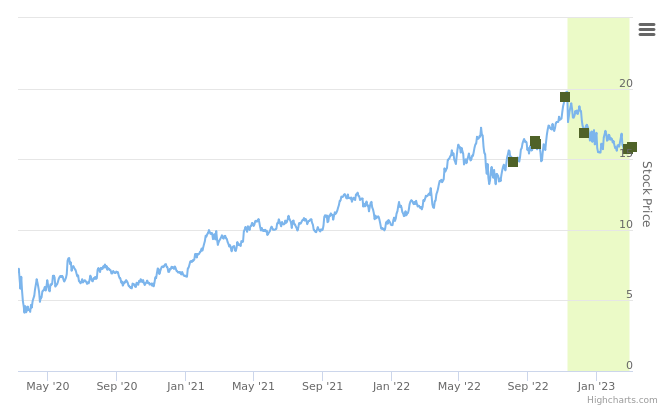

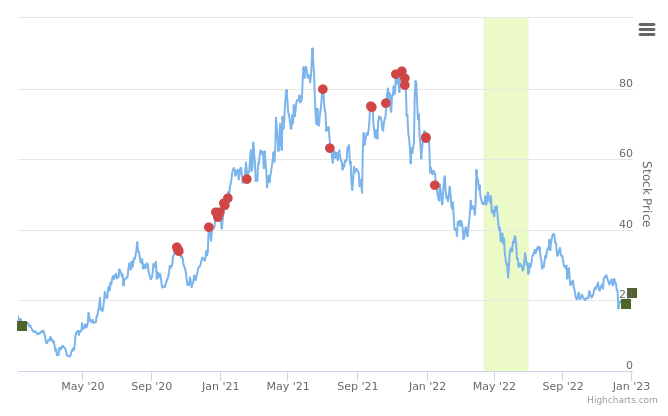

$LPG.US ranked positive on April 4th, 2023

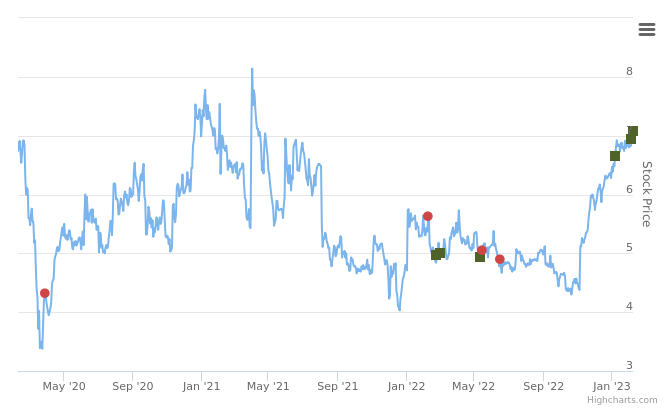

Dorian LPG Ltd (LPG, +N, April 4th) John Hadjipateras (Chair and CEO since 2013) purchased $592,000 of stock on the 31st March at $19.73, increasing his stake by 2%. This is a reversal from a sale at $13.50 in March 2021 (via a tender offer) and a much higher price than his last purchase, at […]