Frequently Asked Questions

Our proprietary method of analysing and reporting data means that experienced analysts read and classify transactions, accurately recording the true nature of a reported trade in a consistent manner. Our software minimises that risk through a series of checks and verifications.

Complex announcements are escalated for a second opinion. Survivor bias is eliminated, historic data includes defunct companies, we never delete transactions.

Data is uploaded into our database using proprietary software and delivered in near real-time to quant clients. Usually, it is around 1,000 trades per day.

Regulatory reports are tracked in real-time ensuring that we know where and when transactions are reported in every market. We use proprietary software to categorise and analyse the metadata before passing it to the appropriate analyst to process.

While processing requires manual oversight by skilled analysts, much of the production and QA process is automated to ensure data is of the highest quality.

– Our know-how process verifies and supplements reported data.

– Built-in algorithms identify data flags and analysis fields, for example, a Director Score.

– Various transaction flags are added to enable sophisticated filtering.

– The core – individual transaction reports authored by issuers (listed companies) and made public under listing rules within each market.

– Additional data from ancillary datasets: corporate reporting dates, salary, buyback data.

Whilst our product incorporates data from multiple sources using proprietary data classifications and analysis fields, our pure quant delivery remains factual and free from subjective analysis or interpretation.

Supplemental fields are based on algorithms and give clients the tools needed to identify trends within transactions.

The aim is to simplify analysis by giving clear signals as to where to find the alpha.

– Every share transaction in listed stocks globally reported by directors and senior management where reporting standards exist.

– Every regulatory report of insider transaction received.

– Every regulatory report of insider transactions reported in any market.

– Every listed stock is monitored.

– Every regulatory report of insider transaction received.

– Over 60 markets – we are global.

– Up to 25 years of historic data depending on the market.

– We have wider coverage and deeper history than any other provider.

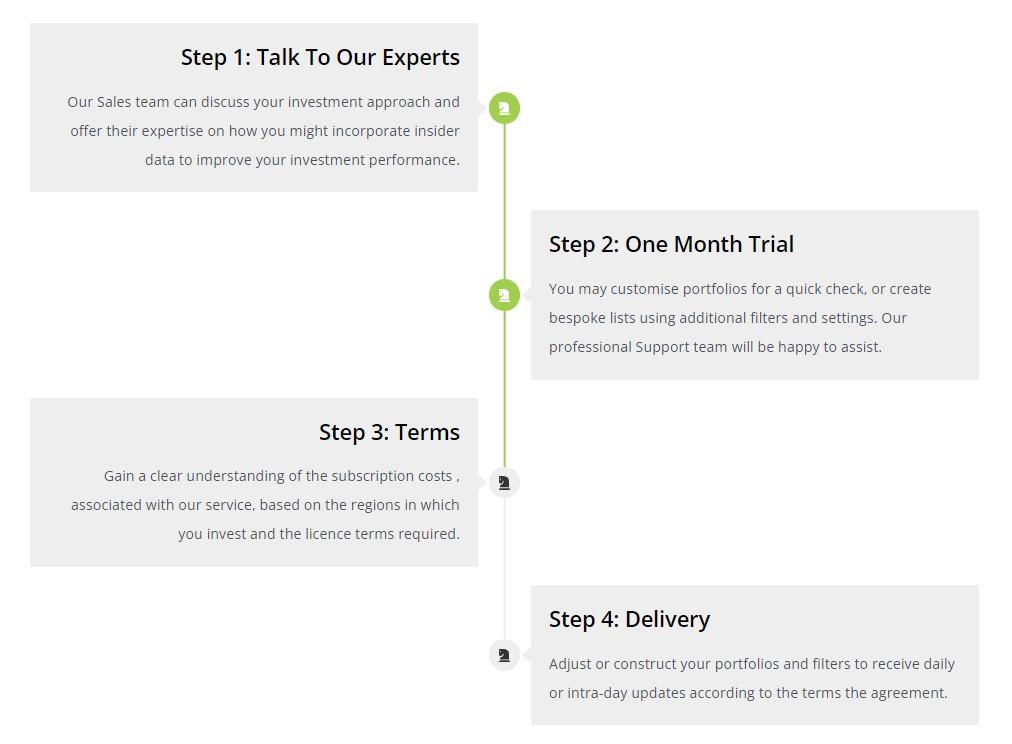

Getting started