Smart Insider

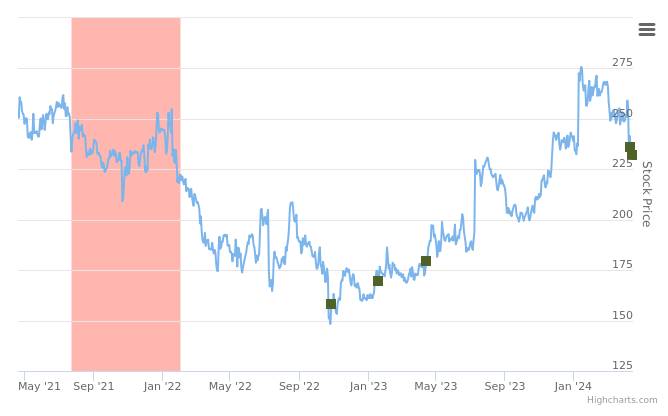

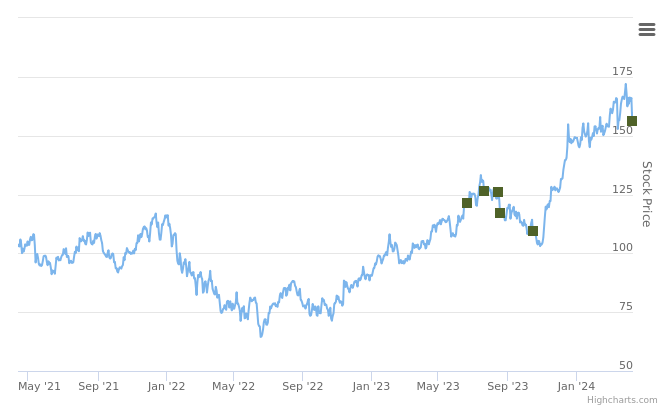

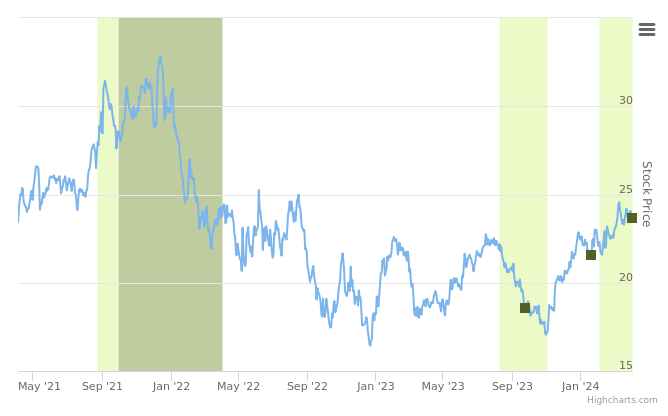

Although company ‘Insiders’ can offer valuable clues related to future share performance, investors are unable to monitor all the relevant trades. Identifying ‘Smart Insiders’ through specialist desktops or quantitative feeds enables our clients to generate alpha.

Our data analytics

Delivery Options

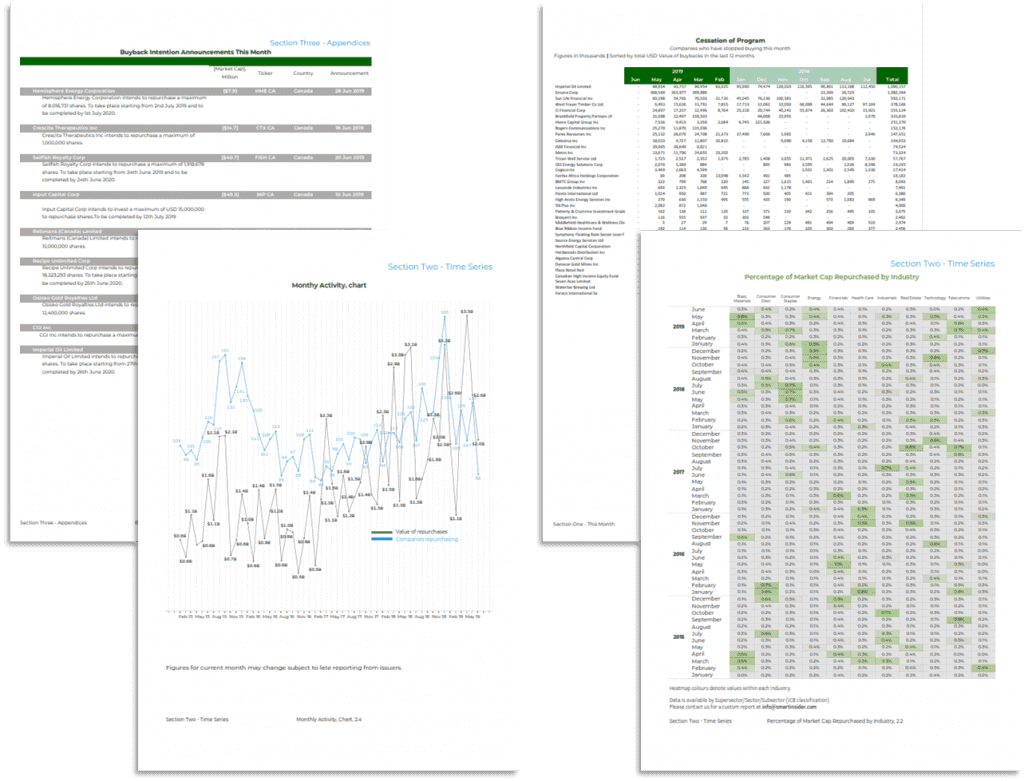

Our quant offering includes both buyback transactions and buyback intentions.

Whether you are a fund manager, investor, company executive, or analyst, our delivery can be customized to the way you look at data and can integrate with your internal processes and workflow. We provide full customization of reports delivered by desktop, through feeds, or alerts. Our quant clients can receive data in a variety of formats via SFTP, API, Snowflake or AWS S3 and include point-in-time processes.

Consists of the timely delivery of share repurchases data and buyback announcements, suited to the needs and preferences of our clients. You will also find advanced presentation materials to provide additional insight.

Have a specific requirement or want to make sure you get the best value? Our sales and support team is always at hand to train you on how to best tailor our corporate buyback data to your needs. We provide customised reports in different formats and deliver them to your expectations.

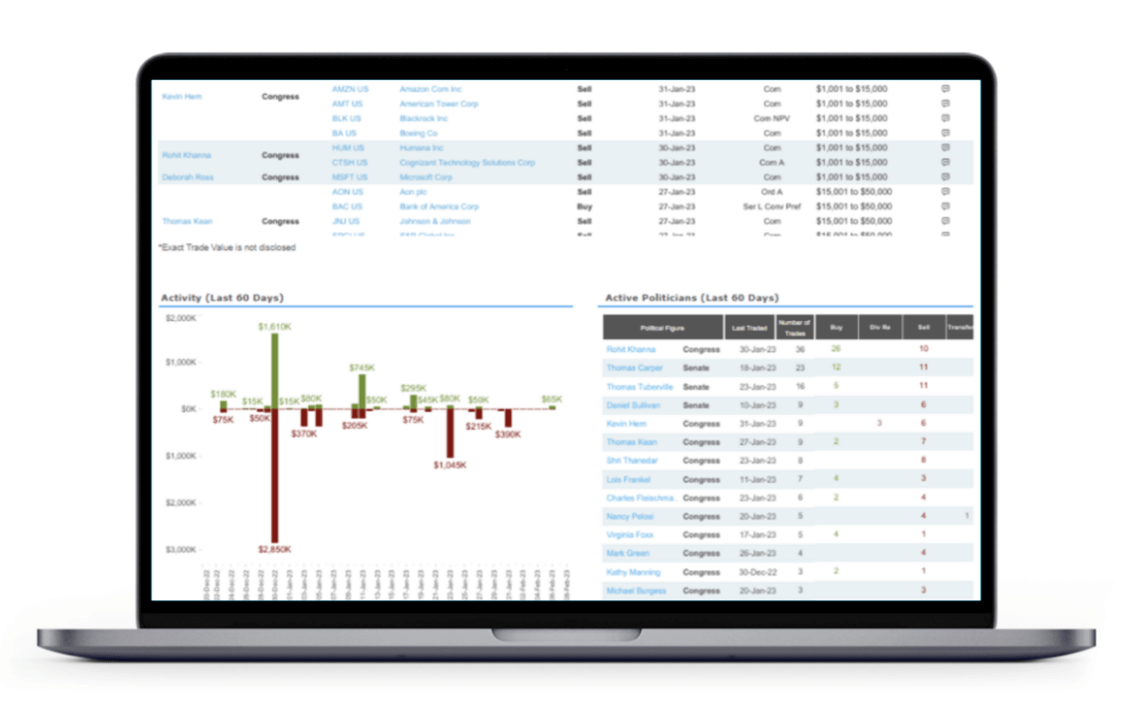

Explore our signals service which consists of the insider trades that matter the most. We conduct high quality quantitative and qualitative analysis and highlight the trades that are most predictive of future share performance. Our research team provides comprehensive insights and commentary on these forecasts.

Delivery Options

Our quant offering includes both buyback transactions and buyback intentions.

Whether you are a fund manager, investor, company executive, or analyst, our delivery can be customized to the way you look at data and can integrate with your internal processes and workflow. We provide full customization of reports delivered by desktop, through feeds, or alerts. Our quant clients can receive data in a variety of formats via SFTP, API, Snowflake or AWS S3 and include point-in-time processes.

Consists of the timely delivery of share repurchases data and buyback announcements, suited to the needs and preferences of our clients. You will also find advanced presentation materials to provide additional insight.

Have a specific requirement or want to make sure you get the best value? Our sales and support team is always at hand to train you on how to best tailor our corporate buyback data to your needs. We provide customised reports in different formats and deliver them to your expectations.

Director Insights

Like the rest of our content, we deliver data to suit the needs of our clients. This may include reports sent to the desktop at defined intervals, to a nightly feed of updates via FTP or an API.

Investor Relations or Human Resource departments can receive a concise list of boardroom personnel changes across a finite list of peer companies.

Like the rest of our content, we deliver data to suit the needs of our clients. This may include reports sent to the desktop at defined intervals, to a nightly feed of updates via FTP or an API.

Our Clientele

- Analysts and Fund Managers seeking to incorporate Insider insights signals into their investment process

- Buyside and Sellside analysts looking for market sentiment data

- Quants looking to enhance systematic strategies with alternative data sources

- ESG specialists seeking aspects of corporate governance

PEOPLE

Head of Research

Quantitative Analyst

Quantitative Research Analyst

Quantitative Strategist

Senior Analyst

INSTITUTIONS

Hedge Funds

Family Offices

Institutional Portfolio Managers

Institutional Investors

Assets Managers

Latest Insights

Smart Insider Data

Smart Insider provides share trade analytics & advanced data inputs for multi factor stock selection models, including actionable insights for institutional investors