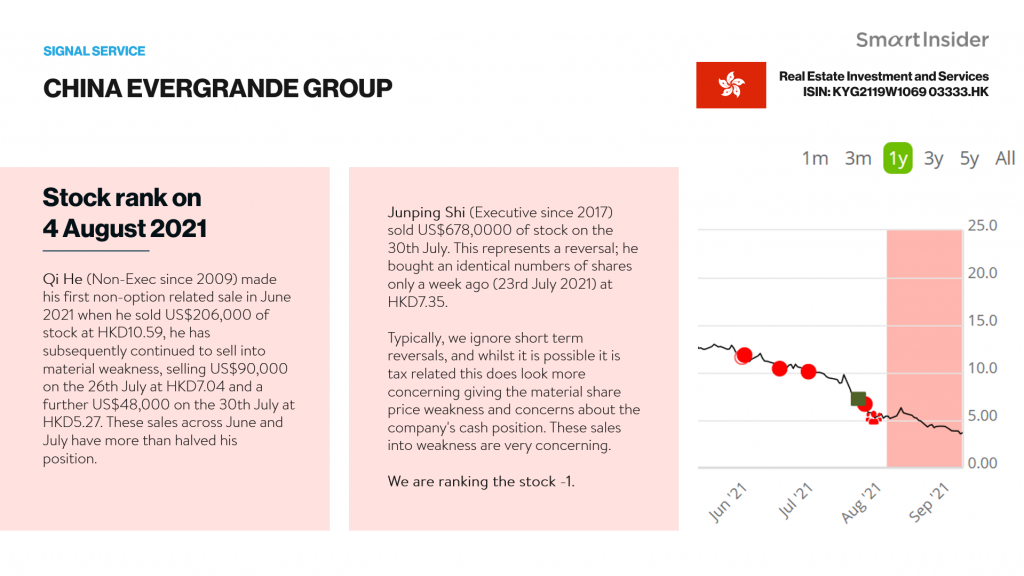

China Evergrande’s share price is under sustained pressure due to funding concerns. We originally negatively ranked the stock on the 4th August 2021 on the back of share sales by two directors. The shares are now down over 34% since we ranked it.

This is what we said in our internal report in August:

Qi He (Non-Exec since 2009) made his first non-option related sale in June 2021 when he sold US$206,000 of stock at HKD10.59, he has subsequently continued to sell into material weakness, selling US$90,000 on the 26th July at HKD7.04 and a further US$48,000 on the 30th July at HKD5.27. These sales across June and July have more than halved his position.

Junping Shi (Executive since 2017) sold US$678,0000 of stock on the 30th of July. This represents a reversal, he bought an identical number of shares only a week ago (23rd July 2021) at HKD7.35.

Typically we ignore short term reversals, and whilst it is possible it is tax-related this does look more concerning giving the material share price weakness and concerns about the company’s cash position. These sales into weakness are very concerning.

We are ranking the stock -1.

Our stock research analysts use decades of experience together with proprietary screening tools to identify key insider trades from company management teams, with a long track record of outperformance. This is our Signals Service. If you are interested in learning more about our service, please get in touch: sales_admin@smartinsider.com or fill in the Contact form.

Subscribe to our Stock of the Week. Follow us on LinkedIn and Twitter.