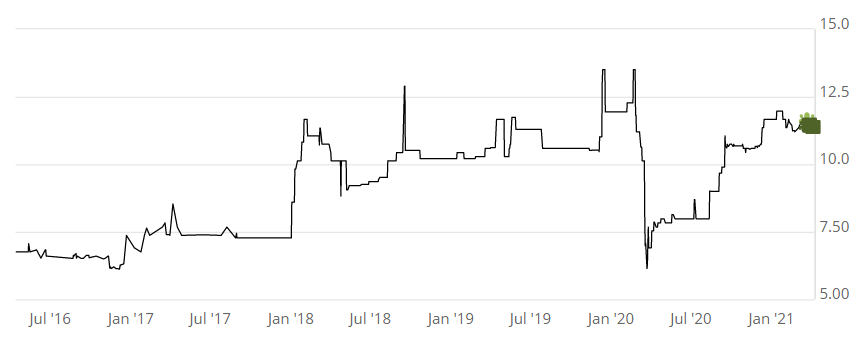

| William Penn Bancorporation – (WMPN, +1) – Four insiders have purchased shares in the past few days in this 150-year-old community bank, just after the bank completed a second-step conversion offering on March 24th at $10 per share. On the offering, seven directors and the CEO purchased a total of 83,124 shares at $10. After the offering, Stephon (CEO since 2018) purchased an additional $50,000 worth of stock at $11.25, after spending $200,000 on the offering. Davis (Director since 1986) purchased $250,000 worth of stock on March 25th at $11.70, Ross (Chief Retail and Commercial Officer, 2019) spends $61,000 on March 29th at $11.45 and Turner (Chief Lending Officer, 2021) spends $125,000 on April 7th at $11.39. This is a solid cluster of buying, at a slight premium to the recent conversion offering. |